The term ‘money maker’ is a phrase I like to use instead of the word budget, as when you use a budget properly, you do start to make more money. You can find your own term but the basic principles of a budget remain the same.

While I am an accountant by profession, my real life lessons in relation to money developed from my life experiences. You could say I learnt how to budget out of necessity rather than as a conscious choice. While studying at University, I was a student with very little money and I had to learn to make the money stretch. Then years later, I was going through my divorce, and I was once again in a financially difficult position. At the time I had three children aged 9 months, 6 and 9 years. I worked part time and was forced to manage my money very carefully. However I learned to survive on a shoe string budget and now have a better understanding of money.

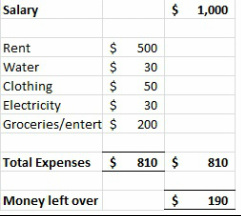

As mentioned in a previous blog, budgeting or making money is looking at how much money you have coming in and going out. This will then tell you how much money you have left over and you can decide how to use the funds. A suggestion may be to pay off any debts or save for a house. The quickest and easiest way to make money is to spend less or reduce your expenses. The alternative is to find other sources of income, such as two jobs. However this affects your personal time and after tax, you are sometimes no better off. The easiest way to make more money is to simply spend less.

The following is a suggestion of how you can work out your own money maker.

Step 1

Income

Add up all the money you have coming in through your work, government benefits, investments and other sources.

Step 2

Expenses

Go through all your credit card and bank statements and work out what you spend money on. You may also find it useful to collect your receipts for a fortnight. A diary may also be useful in recording what you are spending your money on. When you start to do this, you will be surprised at how much you spend on ‘little things.’

For instance, spending $3 on a bottle of soft drink each work day, can add up to $720 year.

Step 3

Non-essential expenses

These are expenses which can be reduced as you do not really need it to survive. We all need shoes and clothes but this purchase can go overboard where you have 100s of pairs of shoes and articles of clothing that you do not really need.

Buying lots of little things can add up to a significant amount within a year.

You could spend $10 on lunch each work day and in a year this can add up to $2,400.

When going out to the pub or restaurant on a Friday and Saturday night, you could easily spend $100. Over a year this will add up to $5,200 a year. You could potentially save yourself a lot of money by simply cutting out some non-essentials in your life.

If you are happy with your finances then you do not have to take my advice on board but if you are worried, stressed and lie awake at night in relation to money, then it is time for you to take some action.

Step 4

Shopaholics

If you do find that you tend to spend a lot of your money on non-essential items, try and work out why you do it. My book dedicates a whole chapter on this topic. Basically a lot of people are trying to fill an emotional hole by ‘going shopping’. Their reasons and what they buy vary, but the basic underlying issue is that they are not happy. The activity of shopping helps them to feel better. If you are in financial difficulty then it is time to explore and analyse the reasons why you shop. You may need to see a trusted counsellor to help you work through this. Keeping a diary is also useful as you can link events to your sudden desire to go and spend money.

Some of the reasons that I have noticed why people shop are low self-esteem, abusive or difficult childhoods, relationship break ups, dysfunctional family relationships, work issues or being in unsatisfactory partnerships. This may sound illogical but I notice that many people, who are in debt, tend to keep spending frivolously. I am not a psychologist so my guess would be that shopping gives them a high, even for a moment, and helps them to forget their problems. The list of why you shop unnecessarily is endless but the main point is that you may be a shopaholic because you are discontent.

Jamie's Story

For instance, Jamie and her husband fought constantly because of her spending and her credit card debt. When Jamie finally kept a diary, she realised that she seemed to go on a spending spree whenever she visited her sister Lindsay. Jamie then realised that Lindsay’s constant criticism of her and her family made her feel bad about herself. Lindsay stopped contact with her sister and found that her self -esteem started to improve. Life started to feel great and her shopping sprees ended.

Jack's story

Then there is Jack who likes to buy the latest gadgets available. His wife Jane is constantly arguing with him that they do not need the items, but since Jack is the main bread winner, he tends to do what he wants. They do not own their home and have significant credit card debt. Jack has low self-esteem as a result of growing up in an abusive household and had never really dealt with what happened to him as a child.

My examples above are based on real life scenarios. If you feel the compulsion to shop for ‘stuff’ then maybe it is time to discover why you do it. You will be surprised at how life will suddenly appear more clearly and how your money worries can reduce and disappear.

Step 5

Once you have all your information, work out what are essential items such as rent, mortgage payments, electricity, gas, insurance, food, school fees, clothing etc. This will provide you with the expenses that are essential for you to live.

Your budget could look something like this:

A signed copy of my book can be purchased by emailing me at karen@karenfernandez.com.au or by sending me a message on Facebook. My book is also available by visiting any online bookstores such as Amazon.

Until next time, be happy and keep smiling.

RSS Feed

RSS Feed